Commission paycheck calculator

Federal Bonus Tax Percent Calculator or Select a state This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and other specialty.

How To Calculate Gross Income Per Month

Ad Payroll So Easy You Can Set It Up Run It Yourself.

. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. In other words if you make a sale for 200 and your commission is.

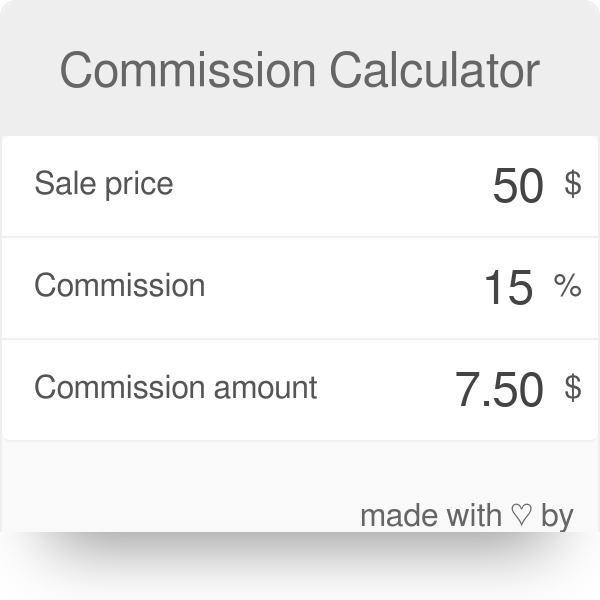

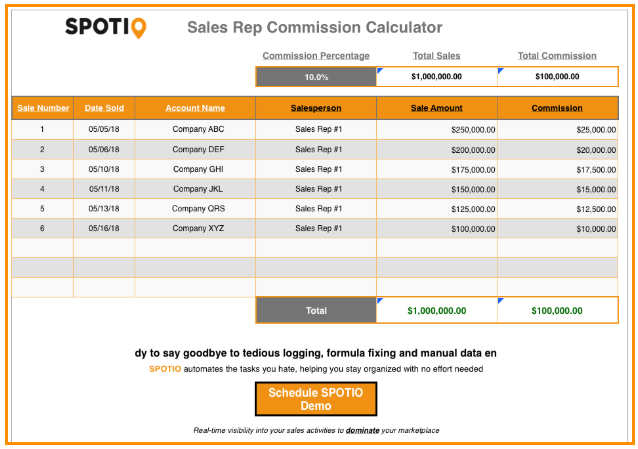

Any bonus or commission payments should be entered so if you expect to be. Employees who are paid in whole or in part by commission and who claim expenses may choose to fill out a Form TD1X Statement of Commission Income and Expenses for Payroll Tax. Just take sale price multiply it by the commission percentage divide it by 100.

Ad See the Paycheck Tools your competitors are already using - Start Now. We use the most recent and accurate information. All Services Backed by Tax Guarantee.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Computes federal and state tax withholding for.

Your employer withholds a 62 Social Security tax and a. You can calculator your commission by multiplying the sale amount by the commission percentage. In a few easy steps you can create your own paystubs and have them sent to your email.

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Simply enter their federal. If you need to purchase ME click HERE.

Read reviews on the premier Paycheck Tools in the industry. How to calculate commission This is a very basic calculation revolving around percents. Heres a step-by-step guide to walk you through.

Base salary Total. With a guaranteed base salary for a salesperson of 2000 plus an additional 5 percent commission on all products sold you calculate pay using this formula. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Ad See the Paycheck Tools your competitors are already using - Start Now. Read reviews on the premier Paycheck Tools in the industry. Next divide this number from the annual salary.

Ad Create professional looking paystubs. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Need help calculating paychecks.

The calculator will automatically calculate the gross income or hours worked depending upon what you enter. Calculate your paycheck at any time using the methods below.

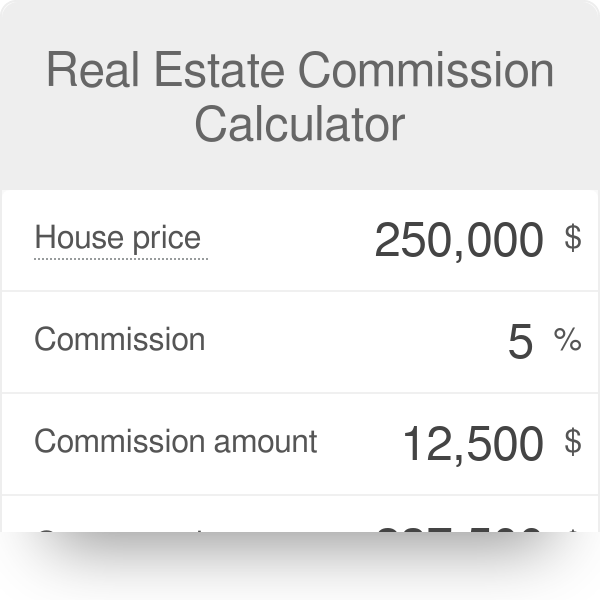

Real Estate Commission Calculator

Bonus Calculator Percentage Method Primepay

Real Estate Commission Calculator Templates 8 Free Docs Xlsx Pdf Real Estate Templates Estates

10 Typical Sales Commission Structures To Motivate Reps With Examples

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Commission Calculator

10 Typical Sales Commission Structures To Motivate Reps With Examples

Understanding Payroll Taxes And Who Pays Them Smartasset

Kentucky Paycheck Calculator Smartasset

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Illinois Paycheck Calculator Smartasset

Massachusetts Paycheck Calculator Smartasset

Oklahoma Paycheck Calculator Smartasset

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

10 Typical Sales Commission Structures To Motivate Reps With Examples