Net present value of cash flows calculator

In this case our net present value is positive meaning that the project is a worthwhile endeavor. An assets net book value is calculated as Net Book Value Original Purchase.

How Internal Rate Of Return Irr And Mirr Compare Returns To Costs Investment Analysis Investing Analysis

The cumulative depreciation from its date of put to use till the present date.

. Home financial finance calculator. Using the Online Calculator to Calculate Present Value of Cash Flows. Suppose a company plans to invest in a project with initial investment amount of 10000.

Once we sum our cash flows we get the NPV of the project. The expected return of 10 is used as the discount rate. For example an individual is wanting to calculate the present value of a series of 500 annual payments for 5.

Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. 5500 on the current interest rate and then compare it with Rs.

Save your data to disk for later use. 6000 6000 6000 18000 ie. Be careful however because the projected cash.

Once the value per dollar of cash flows is found the actual periodic cash flows can be multiplied by the per dollar amount to find the present value of the annuity. Step 4 Next determine the growth rate if any corresponding to the infinite cash flows. Step 6 To arrive at the present value of the perpetuity divide the cash flows with the resulting value determined in step 5.

Cash flows can be regular or irregular. How to Calculate IRR with example. NPV Present value of Inflows Present value of outflows.

Once we calculate the present value of each cash flow we can simply sum them since each cash flow is time-adjusted to the present day. The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates. Or it can be.

Now in order to understand which of either deal is better ie. In project management the NPV is commonly used and also listed in PMIs Project Management Body of Knowledge source. Suitable for auditors accountants lawyers and you.

C cash flow. Step 5 Next determine the difference between the discount rate and the growth rate. It is commonly used because it takes into account considerations for cash inflows cash outflows and the time value of money.

The following table provides each years cash flow and the present value of each cash flow. The expected net cash flow for three years are to be 45004000 and 5500 repectively. The projected sales revenues and other line items for a company can be used to estimate the Free Cash Flows of a company and utilizing the Weighted Average Cost of Capital WACC to discount those Free Cash Flows to arrive at a value for the.

You can skip cash flows or have extra cash flows. Basically it will tell you whether your project has a positive or a negative outlook. Interest Rate discount rate per period.

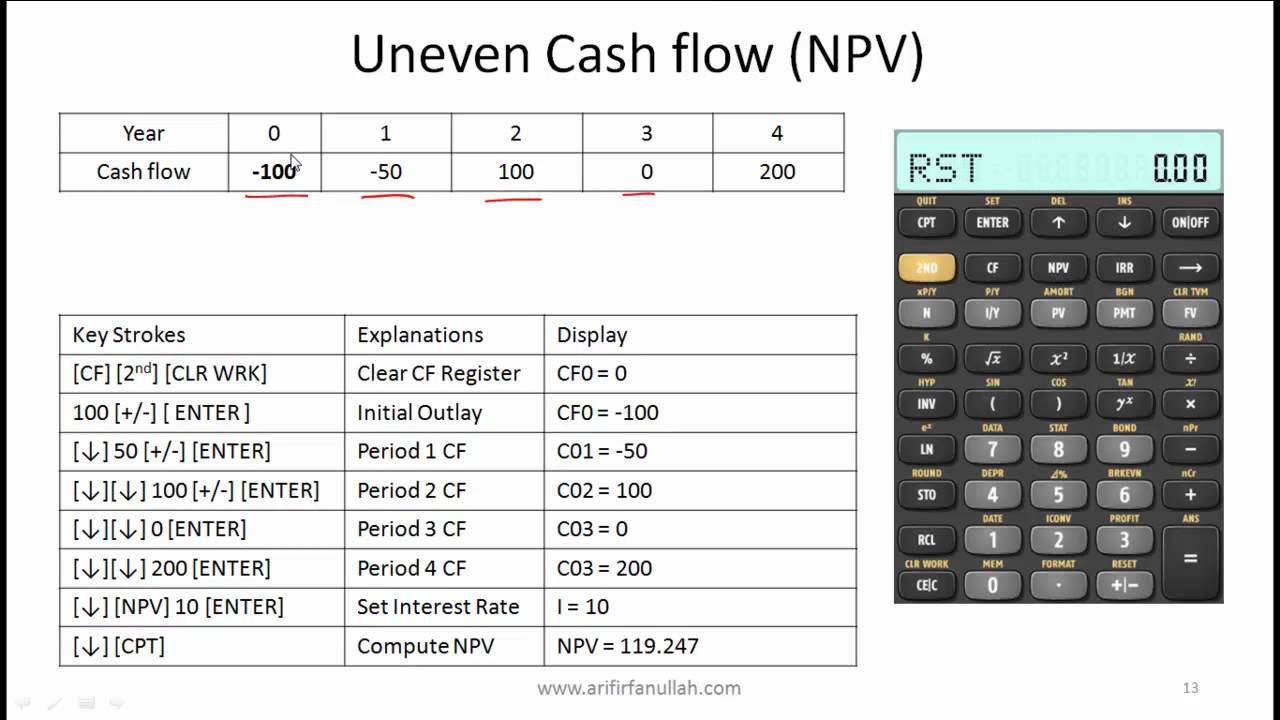

When calculating the net present value the financial calculator can store up to 24 uneven cash flows with up to four-digit frequencies according to Texas Instruments. Find the exact balance for any TVM calculation. Present Worth calculator Present Value Calculator including Present Value formula and how to calculate PV of an asset based on its discount rate.

PMBOK 6th edition part 1 ch. See Present Value Cash Flows Calculator for related formulas and calculations. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at a certain rate.

5000 if the present value of Rs. If you kept that same 1000 in your wallet earning no interest then the future value would decline at the rate of inflation making 1000 in the future worth less than 1000 today. The company estimates that the first year cash flow will be 200000 the second year cash flow will be 300000 and the third year cash flow to be 200000.

The present value is simply the value of your money today. Future cash flows are discounted at the discount. Whether Company Z should take Rs.

C-Value A TVM Calculator for Windows. The present value formula applies a discount to your future value amount deducting interest earned to find the present value in todays money. This rate of return is discounted from the future cash flows.

Time Value of Money Cash Flow optional The change in value from PV to FV can result from accrued interest being added or deducted from the present value. 5000 today or Rs. A popular concept in finance is the idea of net present value more commonly known as NPV.

R internal rate of return. Calculate the Present Value PV of a future sum of money or cash flow based on a given rate of return and investment term. Companies use this metric when planning for capital budgeting and investment.

NPV net present value. When you perform a cost-benefit analysis and need to compare different investment alternatives with each other you might consider using the net present value NPV as one of the profitability indicators. Create and print schedules.

In simple terms NPV can be defined as the present value of future cash flows less the initial investment cost. Net present value NPV lets you know whether the value of all cash flows that a project generates will exceed the cost of starting that particular project. NPV Todays value of the expected cash flows Todays value of invested cash.

A rental property that brings in rental income of 1000 per month a recurring cash flow. Net Present Value - NPV. What is net present value NPV.

Loan or investment calculations. When there are net negative cash flows Negative Cash Flows Negative cash flow refers to the situation when cash spending of the company is. Investors may wonder what the cash flow of 1000 per.

Present value of annuity calculation. Free online finance calculator to find the future value FV compounding periods N interest rate IY periodic payment PMT and present value PV. It allows you to change the cash flow amount and interest rates on any date.

To better understand. Calculate the net present value NPV of a series of future cash flowsMore specifically you can calculate the present value of uneven cash flows or even cash flows. NPV is used in capital.

Net present value NPV is the value of a series of cash flows over the entire life of a project discounted to the present. Present Value - PV. 5500 after two years we need to calculate a present value of Rs.

NPV PV of future cash flows Initial Investment. Net Present Value formula is often used as a mechanism in estimating the enterprise value of a company. This means the higher the discount rate the lower the present value of future cash flows.

5500 is higher than Rs. On the other hand an investment that results in a negative NPV is likely to result in a loss. An extremely flexible time-value-of-money calculator for Windows computers.

You can also assess the impact certain changes have on the cash flow when you edit the inputs. If you have 1000 in the bank today then the present value is 1000. 5000 then it is better for Company Z to take money after two years otherwise take Rs.

Present Value Formula and Calculator. If you end up with a positive net present value it indicates that the projected earnings exceed your anticipated costs and the investment is likely to be profitable. Go for an automatic tool to calculate PV of cash flows if you want to be sure that your calculations are quick and precise.

Net Present Value NPV is the present value of all future cash flows of a project or investment in excess of the initial amount invested.

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Get T Cash Flow Calculator Financial Decisions

Npv Calculator Calculate And Learn About Discounted Cash Flows

Calculate Npv In Excel Net Present Value Formula Excel Excel Hacks Formula

Download Npv And Xirr Calculator Excel Template Exceldatapro Excel Templates Templates Cash Flow

Texas Instruments Ba Ii Plus Tutorial For The Cfa Exam By Mr Arif Irfanullah Youtube Exam Financial Calculator Tutorial

Download Npv And Xirr Calculator Excel Template Exceldatapro Excel Templates Financial Analysis Templates

James Stith This Shows In Different Terms And Currency To Calculate Accounting Rate Of Return Arr

Net Present Value Calculator Template Are You Looking For A Net Present Value Calculator Template In Excel Download T Templates Business Template Calculator

Irr Internal Rate Of Return Definition Example Financial Calculators Balance Transfer Credit Cards Cost Of Capital

Profitability Index Formula Calculator Excel Template Regarding Net Present Value Excel Template Excel Templates Agenda Template Meeting Agenda Template

Net Present Value Template Download Free Excel Template Excel Templates Templates Business Template

Npv Irr Calculator Template Excel Template Calculate Net Present Value Internal Rate Of Return In 2022 Excel Templates Excel Tutorials Excel

Cash Flow Chart Template Elegant Professional Net Present Value Calculator Excel Template Flow Chart Template Invoice Template Flow Chart

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

Net Present Value Npv Financial Literacy Lessons Accounting Education Cash Flow Statement

In This Article We Are Discussing Discounted Cash Flow Analysis By Giving A Real Time Example Of A Company Lets Learn Its Components Cal Cash Flow Flow Cash